An Unbiased View of Pacific Prime

Table of ContentsThe Definitive Guide to Pacific PrimeThe Main Principles Of Pacific Prime What Does Pacific Prime Do?The smart Trick of Pacific Prime That Nobody is Talking AboutHow Pacific Prime can Save You Time, Stress, and Money.

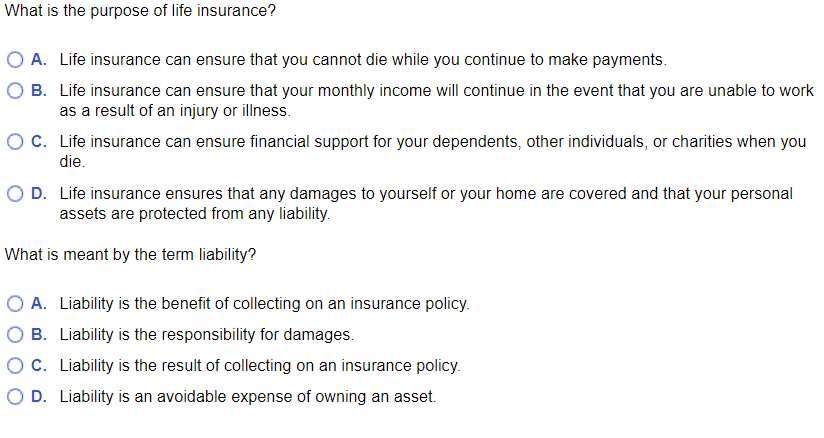

Insurance policy is a contract, represented by a plan, in which an insurance policy holder obtains economic defense or reimbursement versus losses from an insurance policy company. The business pools customers' threats to make payments more budget friendly for the guaranteed. The majority of people have some insurance policy: for their car, their house, their healthcare, or their life.Insurance coverage also helps cover costs related to obligation (legal responsibility) for damages or injury created to a 3rd event. Insurance policy is an agreement (plan) in which an insurance company compensates another versus losses from specific contingencies or dangers. There are many types of insurance policies. Life, wellness, homeowners, and auto are amongst the most common kinds of insurance.

Investopedia/ Daniel Fishel Lots of insurance coverage types are available, and virtually any type of specific or service can find an insurance provider ready to guarantee themfor a cost. Usual personal insurance policy kinds are vehicle, health and wellness, property owners, and life insurance policy. The majority of individuals in the USA contend the very least one of these types of insurance, and cars and truck insurance is required by state law.

Pacific Prime Fundamentals Explained

So finding the price that is ideal for you needs some legwork. The plan limit is the optimum amount an insurance firm will certainly pay for a covered loss under a policy. Optimums may be established per period (e.g., yearly or policy term), per loss or injury, or over the life of the plan, also referred to as the life time optimum.

There are several different types of insurance policy. Wellness insurance helps covers regular and emergency medical treatment costs, usually with the option to add vision and dental services individually.

Nevertheless, numerous preventive services may be covered for totally free before these are met. Wellness insurance may be acquired from an insurance provider, an insurance coverage representative, the government Medical insurance Market, provided by a company, or government Medicare and Medicaid protection. The federal government no more needs Americans to have medical insurance, but in some states, such as The golden state, you may pay a tax obligation charge if you do not have insurance policy.

How Pacific Prime can Save You Time, Stress, and Money.

Instead of paying out of pocket for auto mishaps and damages, individuals pay yearly costs to a car insurance policy company. The company then pays all or a lot of the protected costs related to a car mishap or various other car damages. If you have actually a rented automobile or borrowed cash to acquire a cars and truck, your lending institution or leasing dealer will likely need you to carry vehicle insurance.

A life insurance coverage policy warranties that the insurance firm pays an amount of cash to your recipients (such as a partner or children) if you die. There are 2 major kinds of life insurance policy.

Insurance coverage is a means to handle your financial dangers. When you acquire insurance, you purchase defense versus unexpected financial losses. The insurance policy company pays you or a person you select if something poor happens. If you have no insurance policy and a crash occurs, you might be in charge of all associated expenses.

The Single Strategy To Use For Pacific Prime

There are many insurance coverage policy kinds, some of the most usual are life, wellness, homeowners, and auto. The ideal type of insurance coverage for you will certainly depend upon your objectives and monetary circumstance.

Have you ever before had a minute while looking at your insurance plan or buying for insurance when you've believed, "What is insurance coverage? Insurance policy can be a mysterious and puzzling thing. How does insurance coverage work?

Enduring a loss without insurance policy can put you in a challenging economic circumstance. Insurance coverage is an essential monetary tool.

Pacific Prime Things To Know Before You Buy

And sometimes, like car insurance and employees' compensation, you may be hop over to here needed by regulation to have insurance coverage in order to secure others - international health insurance. Discover regarding ourInsurance alternatives Insurance coverage is essentially a massive nest egg shared by lots of people (called insurance policy holders) and taken care of by an insurance policy copyright. The insurance business utilizes money gathered (called costs) from its policyholders and various other investments to spend for its operations and to satisfy its promise to policyholders when they sue